No products in the cart.

Post Views: 91

In the face of rising job insecurity and economic instability, the need for a second income has become more critical than ever in Pakistan. Gone are the days when relying on a single job was enough to ensure financial stability. Today, we live in an unpredictable world where companies are downsizing, inflation is skyrocketing, and automation is threatening traditional job roles.

In Pakistan, the corporate sector once symbolized stability, but now it’s increasingly unstable. Job losses, salary freezes, and shrinking employment opportunities have become commonplace. As a result, a second income isn’t just an additional source of money—it’s a lifeline that can help families survive and thrive in these turbulent times

"Never depend on a single income. Make investments to create a second source."

Warren Buffett Tweet

Job Insecurity in Pakistan

With job insecurity growing across all sectors, the Pakistani workforce faces unprecedented challenges. A recent survey revealed that 60% of employees are concerned about losing their jobs, and this fear isn’t unfounded. Several factors contribute to this growing concern:

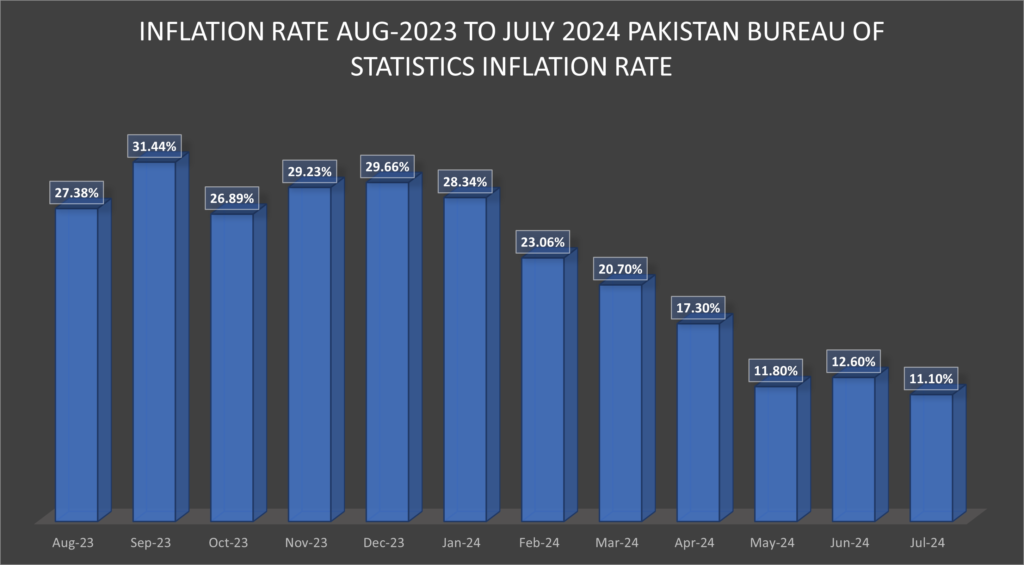

- Economic instability: Pakistan’s economy has been struggling, with inflation rates peaking at around 12% annually (Source: Pakistan Bureau of Stastics.) This has led to lower business profitability and, in turn, layoffs.

- Automation and AI: Traditional job roles, particularly in industries like customer service, retail, and manufacturing, are being replaced by automation, increasing the risk of redundancy.

- Skills gap: Rapid advancements in technology have left a large part of the workforce ill-prepared for new, emerging job roles.

Disheartening statistics further compounds these challenges:

- 20% of companies in Pakistan have reduced staff over the past year (Source: Pakistan Bureau of Statistics).

- The unemployment rate has surged by 10% since 2020 (Source: World Bank).

These figures show that relying on a single job can be a risky financial strategy. In the event of sudden job loss, the absence of a secondary income stream can quickly lead to financial distress.

Economic Crises and Their Impact on Job Stability

The worsening economic crisis in Pakistan has created an even more pressing need for individuals to secure a second income. Some of the most impactful factors include:

- Rising inflation: Prices of essential goods are climbing rapidly, putting pressure on household budgets.

- Currency devaluation: The value of the Pakistani Rupee has declined by 20% against major currencies, which negatively affects purchasing power.

- Debt crisis: Pakistan is burdened with over $100 billion in external debt, and this is directly affecting government spending, which trickles down to the corporate sector.

Moreover, Pakistan’s ongoing brain drain is a troubling sign. Around 50% of the country’s youth are actively considering emigration for better financial opportunities (Source: Gallup Pakistan). This exodus of talent further limits job availability for those who remain.

In such a scenario, having a second source of income provides a much-needed safety net.

"I think it's very important to have a feedback loop, where you're constantly thinking about what you've done and how you could be doing it better. Diversifying your income is part of that strategy."

elon musk Tweet

Why a Second Income is Essential

A second income isn’t just about earning extra money; it’s about building financial resilience. In uncertain times, this can make the difference between surviving and thriving. Here are some key benefits:

- Financial Stability: A secondary income helps individuals maintain a consistent cash flow, especially during periods of job loss or income disruption.

- Debt Reduction: With more disposable income, individuals can pay off debts faster, alleviating long-term financial burdens.

- Increased Savings: A second income allows families to save more, securing their future and enabling investments in education, property, or business.

- Mental Well-being: Financial stress is a significant cause of anxiety and depression. Having an additional income can significantly reduce this mental burden.

Potential Income Sources

Whether you’re looking to monetize a hobby, or skill, or just seeking opportunities online, there are many ways to earn a second income in Pakistan. Here are some common sources:

- Freelancing: Many platforms like Upwork, Fiverr, and Freelancer allow you to offer services such as writing, graphic design, and web development. Earnings can range from PKR 50,000 to 100,000 per month based on your skill level.

- Affiliate marketing: You can promote products online and earn a commission. This can bring in PKR 20,000 to 50,000 per month depending on your marketing strategies.

- Online tutoring: Educational platforms allow you to teach subjects you’re proficient in. This can yield PKR 30,000 to 50,000 per month.

E-commerce: Unlocking Opportunities in Pakistan

Pakistan’s e-commerce sector is witnessing an explosive growth trajectory, making it one of the most lucrative avenues for individuals to earn a second income. According to the State Bank of Pakistan, the country’s e-commerce market is now valued at PKR 100 billion—a staggering figure that reflects the potential for digital entrepreneurs to thrive.

Benefits of E-commerce:

- Low startup costs: Unlike physical businesses, launching an e-commerce store requires minimal investment. Platforms like Shopify, WooCommerce, and Dailymart offer affordable solutions to start your online store.

- Global reach: E-commerce opens up markets beyond geographical boundaries, allowing Pakistani sellers to cater to both local and international customers.

- Flexibility in operations: Manage your e-commerce business from anywhere—whether it’s your living room or a vacation spot.

- Scalability: E-commerce businesses are inherently scalable, meaning you can start small and grow your operations as demand increases.

- Access to a vast customer base: With over 67 million mobile wallets registered and mobile and internet banking users growing rapidly, more consumers are turning to online platforms for shopping.

Growth of Digital Payment Infrastructure in Pakistan

A major driver of e-commerce growth in Pakistan is the expanding digital payments ecosystem. According to a recent State Bank of Pakistan report, the country has seen significant improvements in payment infrastructure:

- 16 million mobile banking users with an 8% quarterly growth.

- 11 million internet banking users growing at 5% quarterly.

- 15% increase in e-wallet registrations, with 2.7 million e-wallets now active.

With 82% of retail transactions being conducted digitally, up from 80% in the previous quarter, the growing accessibility of payment methods offers immense potential for new e-commerce businesses.

Popular E-commerce Platforms in Pakistan

If you’re looking to venture into e-commerce in Pakistan, several platforms make it easy to get started:

- Shopify: A global platform offering comprehensive tools to build an online store.

- Daraz: One of the largest e-commerce platforms in Pakistan.

- WooCommerce: A flexible platform for WordPress users.

- Dailymart.pk: A rising e-commerce marketplace with unique incentives for new sellers.

Emerging Marketplace: Dailymart.pk

Dailymart.pk is a relatively new player in the e-commerce space, offering excellent opportunities for sellers:

- 3 months no commission: DailyMart is waiving commission fees for the first three months, allowing sellers to keep their entire revenue.

- Competitive commission rates: After three months, commission rates are designed to be competitive with other e-commerce platforms.

- Simple registration: Sellers can quickly sign up and set up their online stores with minimal hassle.

- Dedicated customer support: Robust support ensures smooth transactions and seller success.

Tips for Success in E-commerce

- Identify niche products: Focus on unique, specialized products that differentiate you from competitors.

- High-quality product images: Clear and attractive images are key to convincing customers to buy.

- Optimize product listings: Use relevant keywords and comprehensive descriptions to ensure your products appear in search results.

- Provide excellent customer service: Prompt and friendly responses to inquiries can boost your reputation and lead to repeat business.

- Leverage social media: Platforms like Facebook, Instagram, and Twitter are invaluable for marketing your e-commerce business.

- Utilize digital payment solutions: Leverage tools like Raast, Pakistan’s free instant payment solution, to facilitate easier transactions for your customers.

Getting Started with E-commerce on DailyMart

- Register on DailyMart

- Verify your account

- Set up your store with niche products

- Add product listings with optimized keywords

- Start selling and earn your second income!

Additional Resources for E-commerce Entrepreneurs

- E-commerce courses: Platforms like Udemy and Coursera offer comprehensive courses on how to start and scale an online store.

- Pakistan E-commerce Association (PECA): Join for networking and insights into the industry.

- Freelance platforms: Upwork, Freelancer, and Fiverr can be great avenues for additional revenue streams alongside your e-commerce venture.

- Payment guides: Learn how to integrate digital payment solutions like Easypaisa and JazzCash for seamless customer transactions.

"Financial freedom is available to those who learn about it and work for it. The key to building wealth is to have multiple streams of income."

Robert Kiyosaki (Author of Rich Dad Poor Dad): Tweet

Conclusion: Secure Your Future with a Second Income

In today’s economic climate, relying on a single job is a risky strategy. With job insecurity on the rise, a second income isn’t just an option—it’s a necessity. Whether through freelancing, e-commerce, or online tutoring, having an additional income stream is critical for financial security.

By taking advantage of Pakistan’s growing digital payments infrastructure and tapping into the booming e-commerce sector, you can build a sustainable second income and safeguard your financial future.

We’d love to hear from you! Share your thoughts, experiences, or any questions about earning a second income in the comments below. Your feedback helps us create content that better serves you!